Free Debt Consolidation

No contact details required to find out if you qualify

Know more about us and what we can do by clicking on the button below…

1 day 3 days 3 days 8 days 7 days 6 days 12 days 9 days 3 days 6 days 1 day 4 days 2 days 1 day 7 days 5 days 8 days 6 days 12 days 16 days 5 days 8 days 2 days 7 days ago in debt in

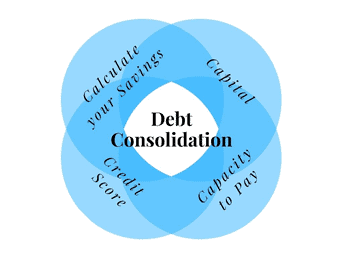

It is a government-approved program which gives you the option to off all your debts with a single loan. You will have a single debt to pay off all other debts at a lower interest. This means you’ll only be making a single payment every month.

It is generally used as a debt relief option to pay off bad debts (credit card debt, car loans, or line of credit debt – all of which can accumulate quickly) that have gotten out of control.

If you have multiple debts such as Credit Cards, Personal Loans, Car Loans, Taxes, CERB, HST, 407, Household Bills, Payday Loans, CERB, and student loan with higher interest rates and is experiencing trouble paying, this debt consolidation program is the best option for you to deal with your debt.

Credit Card debt – This is a type of debt that can accumulate huge interest rapidly. Including this in debt consolidation can greatly cause debt relief.

Personal Loan debt – Having a personal loan for a huge purchase like furniture or home improvements, emergency expenses, medical expenses, and car repair is like an unstoppable train that could suddenly spike up your debt.

Household Bills/Utilities Bills – Missing payments towards your electricity, water, or gas bills can affect your credit score as well. It can also accumulate fees that will keep on adding up if you continue to keep a balance up.

Student Loan – For some provinces, a student loan is allowed to be included in a debt consolidation program to help students or graduates have a fresh start.

Personal Taxes including CERB – CRA is a very powerful debt collector, they can access extreme means to collect taxes. The debt consolidation will help pay off taxes and stop CRA from harassing you.

Use our free debt savings estimate calculator to know if you pre-qualify for a personalized debt consolidation program. If you owe above $10,000 of debt, you pre-qualify for this program. Click the button below to use our free debt savings calculator. Once you fill-up the information, you will be able to speak to one of our specialists to discuss your current financial situation and create a personalized debt savings plan.

As financial institutions will look into the level of risk of lending you the money to pay off other debts, we will have credit rating under review. Unfortunately, those with seriously bad credit won’t be able to get approved.

Creditors will look into your financial status for assurance that you will be able to sustain the debt repayments. Will they be able to get more than they’d normally get if you get defaulted? Your employment status or other income will also matter. These are some of the things they will be checking about your debt consolidation application.

Provide a complete list of all your debts when discussing your debt consolidation with us. This will help us assess your current financial situation accurately and could speed up the process. Remember to include all your debts: Credit Cards, Personal Loans, Car Loans, Taxes, CERB, HST, 407, Household Bills, Payday Loans, and student loan.

We are a team of professional, friendly, and expert debt specialists in the field. We assure you that the program we are creating for you is tailor-fitted based on your financial situation and above all, affordable. What makes our debt consolidation the best in Canada is we offer no Upfront Fees. We will provide you a free consultation, no risks, no obligation, and no commitment.

We give back to the community by donating $1 to every successful 15-minute consultation. No need to go to our office, we can assist you with your questions and concerns through phone call or via Zoom.

You can also read our hundreds of 5-star Google Reviews at this link below.

Stay home and keep away from threats of COVID. Simply click on the below button to get your free consultation via zoom or phone call.

To know more what you can benefit from our Ontario Debt Relief Program, simply try our Debt Consolidation Calculator below and one of our debt specialists will get in touch with you and provide you the best debt relief option that fits your situation.

No contact details required to find out if you qualify

We will help you reduce as much as 75% of your debts and consolidate it into a single affordable monthly payment. Your creditors will stop harassing you and all interest will freeze if you get into our Ontario Government Debt Relief Program.

Many Ontarians are already benefiting from our Debt Relief Program, YOU should too!

Find out how much you can write off portion of your debts by getting your Free Savings Estimate below. A debt specialist from National Debt Relief Services in Ontario will discuss all options and provide you tailor-fitted Debt Relief Program.

SEE IF YOU QUALIFY TO:

No contact details required to find out if you qualify

A Debt Consolidation is a negotiated debt settlement offer made between you and your creditors with the help of a Debt Relief Agency in Ontario. Some key benefits of Debt Consolidation are interest-free program, no upfront fee required, combined monthly payment into one affordable amount, no lawsuits, and many more.

Yes, your assets are safe from creditors. A licensed debt relief agency in Ontario will help you come up with an offer to your creditors that will make sure your assets will be out of the paper.

No, in fact, this is one of the great advantages of a Debt Consolidation Program. All wage garnishment will stop from the day you filed the proposal.

The effect on your credit score is not going to be severe. Your credit score will most probably go to R7 Rating and will remain in your credit report for another 3 years after you completed the program. This means that it will not be permanent and you will still be able to rebuild your credit score.

This varies depending on the proposal you will be discussing with the help of a certified debt relief agency. It is also worth noting that debt consolidation cannot exceed more than 5 years.

If a debt is shared, you need to file a joint debt consolidation offer to your creditors. However, in most cases, in which the debts are individually incurred will have no impact on your spouse.

After three missed payments, your debt arrangement with creditors will be broken and you will end up getting chased again for the original debt amount plus interest.

A debt consolidation offer can be paid off earlier if you can. In this way, you receive your “Certificate of Completion” sooner and you can immediately start rebuilding your credit score.

National Debt Relief Services Ontariois a certified Canadian Debt Relief Agency that offers FREE CONSULTATION to your debt consolidation needs. We value the trust given to us by our clients by making sure your personal information is confidential and private. Our personalized plans are designed to tailor fit your financial capacity. Our specialists will get in touch with you by simply answering a few questions thru the link provided below.

Proud to support financial literacy education

Get a free savings estimate today. There is no obligation.

Free Debt Consolidation

No contact details required to find out if you qualify

Know more about us and what we can do by clicking on the button below…

1 day 3 days 3 days 8 days 7 days 6 days 12 days 9 days 3 days 6 days 1 day 4 days 2 days 1 day 7 days 5 days 8 days 6 days 12 days 16 days 5 days 8 days 2 days 7 days ago in debt in

Ever felt that you are out of options or helpless about all these debts chasing you? We got you!

Our team of debt specialists will not only help you manage your debts (Credit Card Debts, Personal Loans, Car Loans, Taxes, HST, 407, Household Bills, Payday Loans) but also reduce it up to 75% for easier and faster repayments into one single monthly payment.

We are a team of expert debt specialists that provide FREE CONSULTATION to our clients.

No Risks. No Upfront Fees. No Haggles. No Interests.

Never miss this opportunity and choose our Ontario Government-Approved Debt Relief Program as your debt relief option. Stop all your debt worries, sleepless nights, harassing phone calls and take advantage of the benefits you can get from our Ontario Debt Relief Program.

To know more what you can benefit from our Ontario Debt Relief Program, simply try our Debt Consolidation Calculator below and one of our debt specialists will get in touch with you and provide you the best debt relief option that fits your situation.

No contact details required to find out if you qualify

We will help you reduce as much as 75% of your debts and consolidate it into a single affordable monthly payment. Your creditors will stop harassing you and all interest will freeze if you get into our Ontario Government Debt Relief Program.

Many Ontarians are already benefiting from our Debt Relief Program, YOU should too!

Find out how much you can write off portion of your debts by getting your Free Savings Estimate below. A debt specialist from National Debt Relief Services in Ontario will discuss all options and provide you tailor-fitted Debt Relief Program.

SEE IF YOU QUALIFY TO:

No contact details required to find out if you qualify

A Debt Consolidation is a negotiated debt settlement offer made between you and your creditors with the help of a Debt Relief Agency in Ontario. Some key benefits of Debt Consolidation are interest-free program, no upfront fee required, combined monthly payment into one affordable amount, no lawsuits, and many more.

Yes, your assets are safe from creditors. A licensed debt relief agency in Ontario will help you come up with an offer to your creditors that will make sure your assets will be out of the paper.

No, in fact, this is one of the great advantages of a Debt Consolidation Program. All wage garnishment will stop from the day you filed the proposal.

The effect on your credit score is not going to be severe. Your credit score will most probably go to R7 Rating and will remain in your credit report for another 3 years after you completed the program. This means that it will not be permanent and you will still be able to rebuild your credit score.

This varies depending on the proposal you will be discussing with the help of a certified debt relief agency. It is also worth noting that debt consolidation cannot exceed more than 5 years.

If a debt is shared, you need to file a joint debt consolidation offer to your creditors. However, in most cases, in which the debts are individually incurred will have no impact on your spouse.

After three missed payments, your debt arrangement with creditors will be broken and you will end up getting chased again for the original debt amount plus interest.

A debt consolidation offer can be paid off earlier if you can. In this way, you receive your “Certificate of Completion” sooner and you can immediately start rebuilding your credit score.

National Debt Relief Services Ontariois a certified Canadian Debt Relief Agency that offers FREE CONSULTATION to your debt consolidation needs. We value the trust given to us by our clients by making sure your personal information is confidential and private. Our personalized plans are designed to tailor fit your financial capacity. Our specialists will get in touch with you by simply answering a few questions thru the link provided below.

Proud to support financial literacy education

Get a free savings estimate today. There is no obligation.

Copyright © 2019-2024. NationalDebtRelief.ca. All Rights Reserved

100% Canadian Owned & Operated.

*Disclaimer – NationalDebtRelief.ca, is a debt settlement company; not a credit repair or consumer credit counseling company. NDRS doesn’t provide investment, tax or legal advice. NDRS does not provide services or assistance repairing, modifying, improving, or correcting credit entries or credit reporting. NDRS does not assume or pay any debts, receive, hold or control funds belonging to consumers. NDRS’s debt settlement program and advice program is not available in all provinces across Canada. Individual results vary and are dependent on factors such as successful completion of program, creditor cooperation, and ability to save funds by consumer to settle. Read and understand all contract terms and program disclosures before enrolling. Not all clients successfully complete the debt settlement program. We will educate you on how to create a new financial life.