Most Efficient Way To Unlock Home Equity For Ontario And Alberta Homeowners!

Fast & Easy in 3 clicks!

We Help Homeowners Every Single Day

1000+ GOOGLE REVIEWS

We care and it shows in our reviews

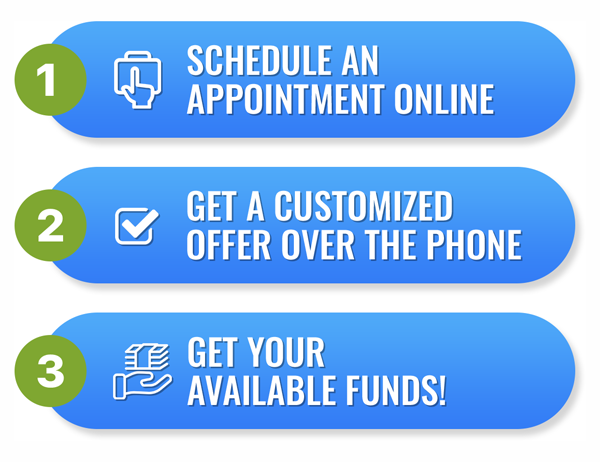

3 Simple & Easy Steps

Best Second Mortgage and Home Equity Options in Ontario & Alberta

Alberta and Ontario Residents use National Debt Relief to prevent selling their homes to pay off bad debt, pay off high-interest rates, GET EXTRA CASH, do home renovations, pay for a vacation or a big celebration, and live a better life debt-free. And it is possible for you too!

Access the equity in your home and clear high-interest debt! We are your best option. The entire process is EASY, SIMPLE, AND FAST.

Lock in a FAVORABLE rate right now! We do the hard work for you – while you relax and sit tight in the comfort of your home! Don’t miss this opportunity, take this one step closer to a better life!

- FAST and EASY Approvals

- Absolutely NO Lenders FEE

- No Income Check

- No Credit Check

- Low-Interest Rates

- Absolutely No HIDDEN Charges

- Super Competitive Rates

We are the best in Canada and it shows in our REVIEWS.

We specialize in unique situations and WILL get you funded quickly!

Get the Most from the Equity of Your Property

We Can Help!

- DEBT CONSOLIDATION

- HOME RENOVATION

- BUSINESS CAPITAL

- VACATION

- EDUCATION

- INVESTMENT

- TEMPORARY NEEDS

- RETIRED INDIVIDUALS

- SELF EMPLOYED

- TAX DEBT

- NEWCOMER TO CANADA

- BUSINESS LOAN

WHY CHOOSE US?

National Debt Relief is the most reliable debt consolidation company in Alberta and Ontario. We have helped homeowners live a debt-free life the EASY AND FAST way!

Our Home Equity Products offer easy-to-access funds that you can use to prevent you from selling YOUR home, IMPROVE your cash flow, eliminate high-interest rates, and get extra cash for important events or renovations.

Get money from your home regardless of your income, age, and even credit history! Our home equity loans allow you to get money fast and easy.

Mortgage solutions

Consolidate debt with home equity

- Make the most out of your Home Equity by consolidating all your high-interest debts into 1 easy and low-interest payment. There is absolutely no need for you to go into consumer proposal or worse - file for bankruptcy.

- You can also skip your monthly payments for up to a year! Helping you take a "debt" vacation and enjoy life!

- Approval is easy, simple, and fast! All credit scores are eligible!

Line of credit and mortgage combo

- HELOC and Mortgage combo is a great deal most especially right now when the current market offers very low rates!

- You can increase your line of credit every time you make mortgage payments!

- Getting access to your home equity has never been easier!

Benefits of Using Our Program

- Prevent Selling Your Home

- Save More Money by Paying Lower Interest Rates

- Improve your cash flow by Getting more CASH

- Get CASH FAST

- Get Money for Vacations or Big Celebrations

- High Approval Rate

- Easy and Simple - Get Approved in the convenience of your home!

- No HIDDEN charges, No Obligation

We Help Homeowners Every Single Day

1000+ GOOGLE REVIEWS

We care and it shows in our reviews

FREQUENTLY ASKED QUESTIONS

National Debt Relief is a reputable debt consolidation company in Canada offering easy, fast, and simple government-approved debt relief programs.

With HELOC or Home equity, this will be a secured loan where your property serves as the security for the loan. Hence, this is available to people who are in debt or are unable to fulfill their payment obligations multiple times and are homeowners.

The application is really simple. You just need to book a consultation with our Senior Credit Counselors who will help you assess your current financial situation and identify the options available for you. The process is seamless and you can do this all in the comfort of your home! Plus, there are no upfront fees.

We offer the lowest and the best interest rates in the country – this is guaranteed.

We will first need to identify the total amount you need and a personalized calculation of your interest rates and monthly amortization will be provided to you.

You will get big savings with our program.

Absolutely no! You don’t pay us anything! The lending company will be the one to pay us so our services to you is completely free! Don’t worry about hidden charges because there is NONE.

YES! Everyone deserves a second chance. Everyone is welcome to apply as long as you have an existing mortgage in place and is need of money!

We will also help you rebuild your credit through our debt consolidation program. Really, you have nothing to lose!

Currently, we cater to Ontario and Alberta. But our services are not limited in these areas. Since the consultation can be done online – practically we can help anyone in Canada.

No, after entering into one of our program your payment towards it will be distributed amongst your creditors based on the reduction achieved. You will only have to make one single monthly payment towards all of your debts.

RECENT BLOG POSTS

We share everything we know about, alternative lending on our blog (and it’s a lot).

We like to think of our audiences as friends. Read and share our Alpine Blog posts, news, updates, etc.

Individual Finance: The Approach to Financial Freedom

Learn how to reduce your debt by 50-80% within 5-7 days Free Debt Consolidation Get Your Free Savings Estimate SEE OUR FORMULA No contact details

A Guide to Debt Relief Programs in Ontario

Learn how to reduce your debt by 50-80% within 5-7 days Free Debt Consolidation Get Your Free Savings EstimateSEE OUR FORMULA No contact details required

Top Debt Relief Programs in Canada: Your Path to Financial Freedom

Learn how to reduce your debt by 50-80% within 5-7 days Free Debt Consolidation Get Your Free Savings Estimate SEE OUR FORMULA No contact details